After the past few years’ frenzied market, the market is hitting more of a buyer-seller equilibrium, with inventory levels moving up ever so slightly, buyers getting used to a new normal of interest rates, prices generally holding steady, and high-end home seekers expanding their reaches to more parts of the globe.

There are lots of changes happening, and the report explores them in depth—everything from the newest tech tools currently disrupting the real estate market, from artificial intelligence to smart-home technology, to pinpointing the parts of the world where tax incentives are increasingly enticing wealthy citizens.

Luxury Outlook 2024 also looks at the growing importance of sustainability and climate resilience to home builders and buyers, how hybrid work has shifted the world’s real estate needs, and how provenance can help homes sell.

This is a difficult time when it comes to geopolitical challenges, with several conflicts raging around the world at once. That makes it difficult to predict what the future will bring, and whether an intensification of conflict could affect financial markets.

For now, there continues to be economic uncertainty into 2024, despite some sporadic positive news. In the U.S., for one, economic growth accelerated in the fourth quarter of 2023, according to the Commerce Department.

While many experts are torn about the effects the conflicts are likely to have from a financial perspective, many market watchers predict an overall positive 2024 for the real estate market. As Sotheby’s International Realty CEO Philip A. White Jr. points out in his interview, Freddie Mac is forecasting prices rising by 0.8% between August 2023 and August 2024, followed by another 0.9% gain in the following 12 months, pointing to “tremendous” demand for houses relative to supply, continuing “to keep upward pressure on prices.”

For now, at least, most of the worries about the real estate market stalling due to rising interest rates haven’t come to fruition, with demand strong, as people move both because they’re going through major life events—such as new children and new jobs—or simply because they want to upgrade their homes and, with it, their lifestyle.

Speaking of the lifestyle factor, as always, we explore the high-end purchases people are making outside the real estate realm, including art, collectibles, and more.

Luxury buyers and sellers want to spend wisely, and staying well-informed is just the way to do it.

Read the Luxury Outlook 2024 by clicking here.

The Gasparilla Inn & Club is the perfect destination for those looking for a sunny respite with an Old Florida feeling and updated and inviting interiors by noted designer Celerie Kemble.

The profile appears in the Jan/Feb 2024 edition of Southern Home magazine.

Read more here.

Gulf to Bay Sotheby’s International Realty has just signed on to be a sponsor for the 5th Annual Boca Grande Film Festival.

The three day festival will be hosted by the Friends of Boca Grande and runs from February 22nd-24th.

The Boca Grande Film Festival was created to bring the community together through film culture and cinematic experience. Each year, organizers curate a lineup of the top films and documentaries in the festival circuit. Throughout the festival, the audience will have the chance to vote for each film, and at the end of the festival we will announce the Audience Winner at the closing reception!

For more information click here.

On Saturday, December 9th, 2023, the Annual Lighting of the Lighthouse took place in Boca Grande, Florida. Attendees journeyed to the southern tip of Gasparilla Island and enjoyed a Christmas concert by Rob Rolleri with appetizers prior to the event.

As dusk fell, the crowd hushed and the Port Boca Grande Lighthouse was transformed into a beacon of seasonal spirit.

This annual event serves as a fundraiser for the Barrier Island Parks Society (BIPS). BIPS manages and operates three historic sites, supports four state parks, manages two gift shops, a bike and kayak rental program at Cayo Costa, Beach Ambassador, Light Keeper and Bird Stewardship programs and much more. BIPS has many exciting educational programs and events slated for the upcoming year that they directly support and are eager to help those new to the island reconnect with nature at all ages.

Learn more at https://www.bips.org/

On November 25th, 2023 the agents and staff of Gulf to Bay Sotheby’s International Realty participated in the Boca Grande Area Chamber of Commerce’s Annual Christmas walk in downtown Boca Grande, Florida.

Attendees were treated to a sparkling wonderland of Gasparilla Island and its most enviable homes transposed into gingerbread form.

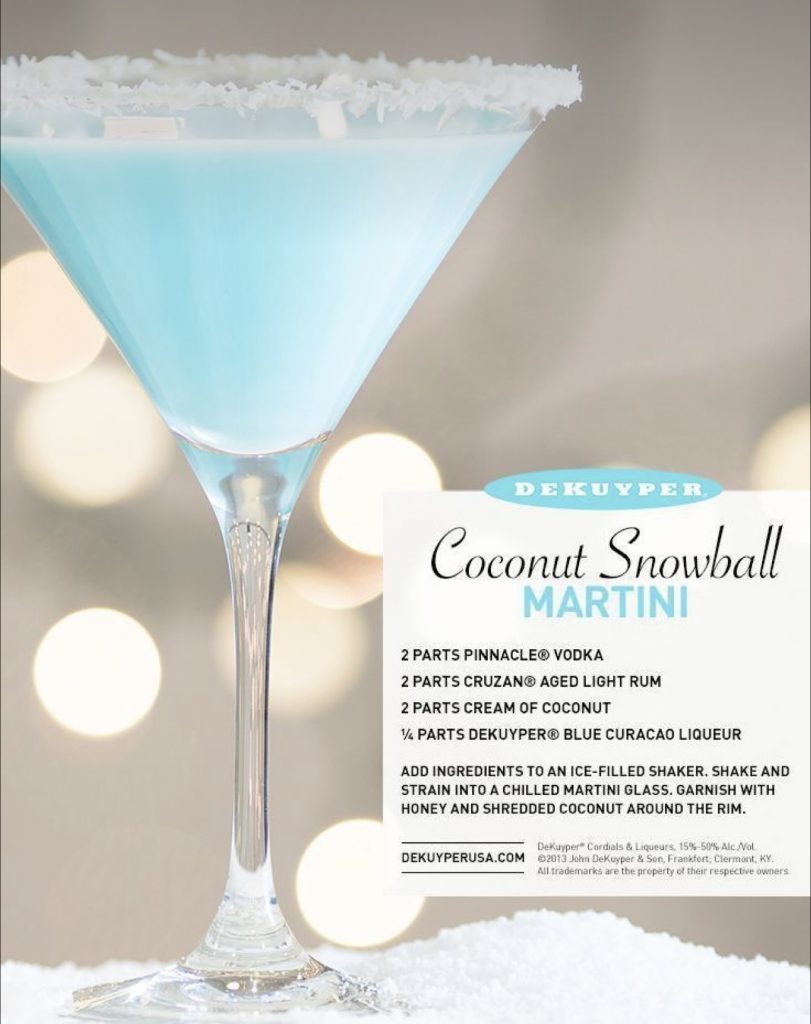

Gulf to Bay Sotheby’s International Realty’s Rental Director, Taylor Guilerm, and her team dipped over 200 pretzel rods in Ghirardelli chocolate and crushed peppermints while serving charcuterie cups, setting out decadent platters of treats and serving their signature Coconut Snowball Martini.

Special thanks to Colleen Heincelman, Dee Sullivan and Keri Ducy for their hard work and planning to make this event such a success!

The recipe for the Christmas Walk’s official cocktail thanks to DeKuyper.

Peter Sieglaff, Angela Steffan and Zeke Sieglaff of the Steffan Sieglaff Team celebrate with Gulf to Bay Sotheby’s International Realty’s broker Karen Danner.

Gulf to Bay Sotheby’s International Realty would like to recognize the Steffan Sieglaff Team who have reached a significant professional milestone.

The team has sold $100,000,000 worth of property in 2023. This is a huge accomplishment and a result of their hard work and exceptional service to their clients.

Congratulations!

The Gasparilla Inn was featured in the Fall Winter edition of Midwest Living Magazine.

In the article, “Take a Winter Jaunt Down South to These 8 Beach Resorts,” the Inn was featured as a top destination for snowbirds looking to escape the cold of winter.

From rooms with beach facing balconies to private cottages and sumptuous breakfasts, the Inn offers the ultimate resort experience, modern amenities and a dash of Old Florida decor that is not to be missed.

Read the entire article from Midwest Living by clicking here.

Gulf to Bay Sotheby’s International Realty is excited to be a featured sponsor in the Boca Grande Chamber of Commerce 2023 Scholarship Golf Scramble.

Last held in 2019, this event raised over $26,000 and helped support 25 students in their academic endeavors. Now it is returning after Covid-19 and Hurricane Ian with a full slate of local sponsors and a field of 100 players.

Scheduled to take place on November 6th, 2023 at the Wellen Park Golf and Country Club, registration will take place at 11:00am with a shot gun start at 12:30pm. This is an 18-hole format with four player scramble with three flights, no handicaps. Teams will be flighted by the club pro based upon front or back scores. There is a maximum of 100 players for this event.

The entry fee includes green fees, a sleeve of Titleist Pro VI balls, a box lunch, beverages, cart rental and catered awards at Capstan Financial Consulting Group.

Click here to register.